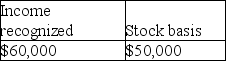

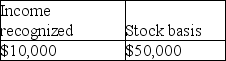

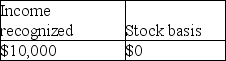

Tonya is the 100% shareholder of a corporation established five years ago.It has always been an S corporation.After adjustment for this year's corporate income,but before taking distributions into account,Tonya has a $50,000 stock basis.The corporation pays Tonya a $60,000 cash distribution.As a result of this distribution,Tonya will have an ending stock basis and recognized income of

A)

B)

C)

D)

Correct Answer:

Verified

Q107: Which of the following characteristics can disqualify

Q112: All of the following are requirements to

Q123: A new corporation is formed on January

Q128: Stephanie owns a 25% interest in a

Q128: Empire Corporation has operated as a C

Q132: Tony is the 100% shareholder of a

Q135: Worthy Corporation elected to be taxed as

Q137: On January 1 of this year (assume

Q140: An S corporation distributes land with a

Q1278: Minna is a 50% owner of a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents