To help retain its talented workforce,Zapper Corporation opens a child care facility in the building next to its offices.It spends $200,000 on rent,salaries and supplies.With respect to the $200,000 expenditure,Zapper will be entitled to a tax credit and a tax deduction of

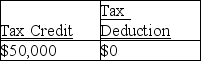

A)

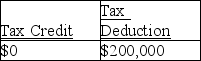

B)

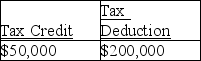

C)

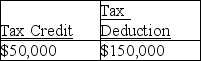

D)

Correct Answer:

Verified

Q101: Sam and Megan are married with two

Q102: If an employee has more than one

Q105: In 2017,Rita is divorced with one child.She

Q109: With respect to estimated tax payments for

Q110: An individual with AGI equal to or

Q111: Which of the following expenditures will qualify

Q113: Dwayne has general business credits totaling $30,000

Q114: Tyne is single and has AGI of

Q127: Bob's income can vary widely from year-to-year

Q134: Individuals who do not have minimum essential

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents