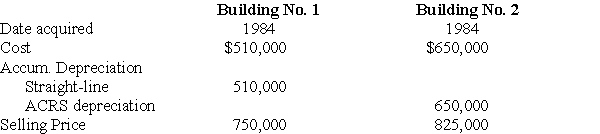

An unincorporated business sold two warehouses during the current year.The straight-line depreciation method was used for Building No.1 and the accelerated method (ACRS) was used for Building No.2.Information about those buildings is presented below.

How much gain from these sales should be reported as Sec.1231 gain and ordinary income due to depreciation recapture?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q27: If the accumulated depreciation on business equipment

Q41: Unrecaptured 1250 gain is the amount of

Q42: Sec.1245 can increase the amount of gain

Q52: When corporate and noncorporate taxpayers sell real

Q59: During the current year,Hugo sells equipment for

Q60: The following gains and losses pertain to

Q71: Emily,whose tax rate is 28%,owns an office

Q75: With regard to noncorporate taxpayers,all of the

Q1729: What is the purpose of Sec. 1245

Q1734: A business plans to sell its office

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents