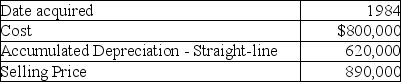

A corporation sold a warehouse during the current year.The straight-line depreciation method was used.Information about the building is presented below:

How much gain should the corporation report as Sec.1231 gain?

A) $124,000

B) $620,000

C) $586,000

D) $710,000

Correct Answer:

Verified

Q63: In addition to the normal recapture rules

Q65: When appreciated property is transferred at death,the

Q66: Trena LLC,a tax partnership owned equally by

Q73: Ross purchased a building in 1985,which he

Q77: Gifts of appreciated depreciable property may trigger

Q83: Describe the tax treatment for a noncorporate

Q84: In 1980,Artima Corporation purchased an office building

Q86: Connors Corporation sold a warehouse during the

Q93: If no gain is recognized in a

Q98: Octet Corporation placed a small storage building

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents