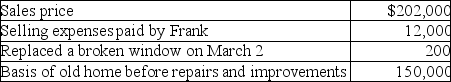

Frank,a single person,sold his home this year.He had owned and lived in the house for 10 years.Frank signed a contract on March 4 to sell his home and closed the sale on May 3.

Based on these facts,what is the amount of his recognized gain?

A) $0

B) $39,800

C) $40,000

D) $52,000

Correct Answer:

Verified

Q86: Lana owned a house used as a

Q90: Which of the following statements is false

Q101: Sometimes taxpayers should structure a transaction to

Q105: William and Kate married in 2017 and

Q108: Hannah,a single taxpayer,sold her primary residence on

Q113: Pierce sold his home this year.He had

Q116: James and Ellen Connors,who are both 50

Q120: Nicki is single and 46 years old.She

Q1887: Ike and Tina married and moved into

Q1893: In 1997, Paige paid $200,000 to purchase

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents