This year,John purchased property from William by assuming an existing mortgage of $40,000 and agreed to pay an additional $60,000,plus interest,in the 3 years following the year of sale (i.e.$20,000 annual payments for three years,plus interest) .William had an adjusted basis of $44,000 in the building.What are the sales price and the contract price in this transaction?

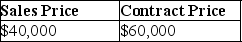

A)

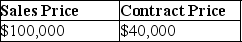

B)

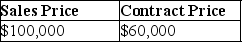

C)

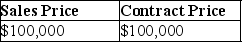

D)

Correct Answer:

Verified

Q61: Kevin sold property with an adjusted basis

Q64: On July 25 of this year,Raj sold

Q72: Which of the following conditions are required

Q85: On June 11 of last year,Derrick sold

Q91: Nick sells land with a $7,000 adjusted

Q91: On September 2 of this year,Keshawn sold

Q97: On May 18 of last year,Carter sells

Q97: Freida is an accrual-basis taxpayer who owns

Q98: Marissa sold stock of a non-publicly traded

Q99: In 2017,Modern Construction Company entered into a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents