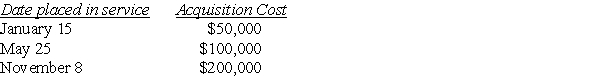

Mehmet,a calendar-year taxpayer,acquires 5-year tangible personal property in 2017 and does not use Sec.179.The property does not qualify for bonus depreciation.Mehmet places the property in service on the following schedule:

What is the total depreciation for 2016?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q42: All of the following are true with

Q62: Everest Corp.acquires a machine (seven-year property)on January

Q67: Unless an election is made to expense

Q69: In July of 2017,Pat acquired a new

Q69: Taxpayers are entitled to a depletion deduction

Q72: Off-the-shelf computer software that is purchased for

Q74: In July of 2017,Pat acquired a new

Q77: On May 1,2012,Empire Properties Corp. ,a calendar-year

Q77: On January 1 of the current year,Dentux

Q88: In calculating depletion of natural resources each

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents