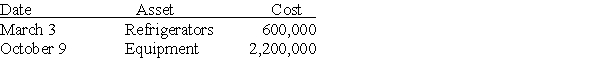

During the year 2017,a calendar-year taxpayer,Marvelous Munchies,a chain of specialty food shops,purchased equipment as follows:

Assume the property is all 5-year property,but does not qualify for bonus depreciation.What is the maximum depreciation that may be deducted for the assets this year,2017,assuming Sec.179 expensing is not elected?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q64: In the current year George,a college professor,acquired

Q65: Enrico is a self-employed electrician.In May of

Q67: On May 1,2008,Empire Properties Corp. ,a calendar-year

Q69: Greta,a calendar-year taxpayer,acquires 5-year tangible personal property

Q72: In April of 2016,Brandon acquired five-year listed

Q75: In August 2017,Tianshu acquires and places into

Q76: Enrico is a self-employed electrician.In May of

Q78: On January l,Grace leases and places into

Q79: Arthur uses a Chevrolet Suburban (GVWR 7,500

Q2094: Jack purchases land which he plans on

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents