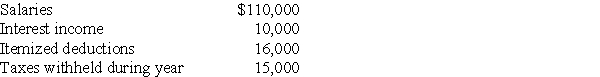

Brad and Angie had the following income and deductions during 2017:

Calculate Brad and Angie's tax liability due or refund,assuming that they have 2 personal exemptions.They file a joint tax return.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q50: Organizing a corporation as an S Corporation

Q53: Individuals are the principal taxpaying entities in

Q55: Which of the following is not one

Q57: Flow-through entities do not have to file

Q60: In a limited liability partnership,a partner is

Q65: Firefly Corporation is a C corporation.Freya owns

Q76: Which of the following is not an

Q77: All of the following are classified as

Q78: During the current tax year,Charlie Corporation generated

Q2194: A presidential candidate proposes replacing the income

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents