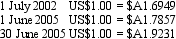

The net assets of a foreign operation at 30 June 2005 are constituted as assets of US$400,000 and liabilities of US$250,000.The parent entity purchased the foreign subsidiary on 1 July 2002.Exchange rate information is as follows:  The foreign operation has not traded during the year ended 30 June 2005,so the net assets remained unchanged during the period.What is the parent entity's foreign currency exposure for the year ended 30 June 2005?

The foreign operation has not traded during the year ended 30 June 2005,so the net assets remained unchanged during the period.What is the parent entity's foreign currency exposure for the year ended 30 June 2005?

A) Foreign exchange gain $A197,185.

B) Foreign exchange gain $A20,610.

C) Foreign exchange gain $A342,310.

D) Foreign exchange loss $A6,002.

E) None of the given answers.

Correct Answer:

Verified

Q11: As prescribed in AASB 121,in translating the

Q16: AASB 121 prescribes alternative methods for the

Q21: Rudd Ltd,an Australian entity purchased Lee Ltd

Q22: Under the translation method required by AASB

Q23: Ramikin Co is a fully owned subsidiary

Q25: Under the translation method required by AASB

Q26: Yarra Manufacturing Ltd is an Australian registered

Q27: AASB 121 specifies that post-acquisition movements in

Q28: In the process of consolidating the translated

Q29: Emu Co Ltd purchased a foreign operation

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents