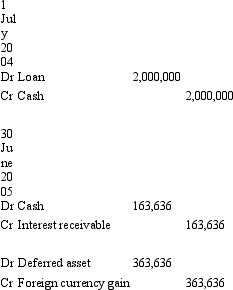

On 1 July 2004 Waugh Ltd enters into an arrangement with a US bank - Big Bank - to borrow US$900,000.The term of the loan is 3 years with interest payable annually in arrears on 30 June at the rate of 10 per cent.The exchange rate information is:  What journal entries are required in Waugh Ltd's books for 1 July 2004 and 30 June 2005 in accordance with AASB 121 (rounded to the nearest whole $A) ?

What journal entries are required in Waugh Ltd's books for 1 July 2004 and 30 June 2005 in accordance with AASB 121 (rounded to the nearest whole $A) ?

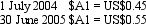

A)

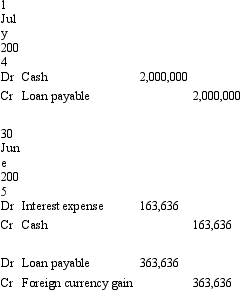

B)

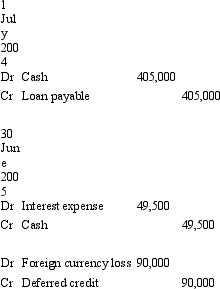

C)

D)

E) None of the given answers.

Correct Answer:

Verified

Q26: Examples of monetary items that may be

Q27: AASB 121 requires that foreign currency monetary

Q28: The Big Mac index is:

A) An indicator

Q29: What is the required treatment for long-term

Q30: The exchange rate for a currency depends

Q33: Safety Ltd purchased goods for £20,000 from

Q34: On 1 May 2005 Harriet's Importers Ltd

Q35: AASB 121 requires that the initial recognition

Q36: On 1 May 2005 Harry's Plastics Ltd

Q47: For a cash flow hedge relating to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents