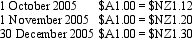

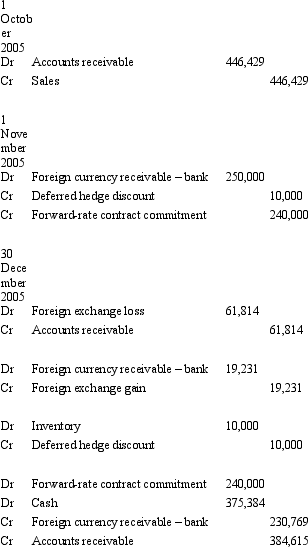

Emu Exports Ltd sold products to a New Zealand company.The sales contract was denominated in $NZ.On 1 October 2005,$NZ500,000 worth of products were sold with the terms f.o.b.shipping point and payment due 30 December 2005.A forward-exchange contract in which the bank agrees to purchase $NZ300,000 from Emu Exports on 30 December 2005 is entered into on 1 November 2005.The forward-exchange rate is $A1 = $NZ1.25.Other exchange rates are as follows:  What are the journal entries to record the above transactions from 1 October through to 30 December 2005 in accordance with AASB 121 (rounded to the nearest whole $A) ?

What are the journal entries to record the above transactions from 1 October through to 30 December 2005 in accordance with AASB 121 (rounded to the nearest whole $A) ?

A)

B)

C)

D)

E) None of the given answers.

Correct Answer:

Verified

Q48: The following items are in the financial

Q49: Which of the following statements is correct

Q50: On 1 July 2005 Jarrets Ltd borrows

Q51: The functional currency of an entity:

A) never

Q52: Which of the following items is not

Q53: In terms of retrospectively assessing hedge effectiveness,which

Q54: Which of the following items is within

Q55: Exchange differences recognised as borrowing costs and

Q57: On 5 September 2004 Russell Ltd places

Q58: The three principal types of hedges referred

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents