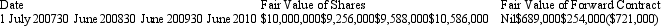

The following data is provided for the fair value of a share portfolio,and the fair value of a forward contract taken out on 1 July 2007 to 'hedge' movements in the fair value of the shares.Assume the hedge was highly effective at inception of the hedge.  Which of the following statements is true?

Which of the following statements is true?

A) It is not an effective hedge as there was a difference of $10,000,000 between the fair values of the shares and the forward contract at inception.

B) It is not an effective hedge as a forward contract cannot be used as a hedging instrument.

C) It is an effective hedge as the movement in the fair value of the hedging instrument between 1 July 2007 and 30 June 2010 offset movements in fair value of the shares in the same period, which is within the 80/125 per cent hedge effectiveness range.

D) It is an effective hedge as the movements in the fair value of the hedging instrument offset movements in fair value of the shares and stayed within the 80/125 per cent hedge effectiveness range throughout the period to 30 June 2010.

E) It is not an effective hedge as the movements in the fair value of the hedging instrument failed to offset movements in the fair value of the shares and stay within the 80/125 per cent hedge effectiveness range throughout the period to 30 June 2010.

Correct Answer:

Verified

Q36: On 1 May 2005 Harry's Plastics Ltd

Q37: Apart from some limited exceptions,AASB 121 requires

Q38: The spot rate is defined in AASB

Q39: The effect of an increase in the

Q40: On 1 July 2003 Kanga Consultants Ltd

Q42: On 1 July 2005 Jarrets Ltd borrows

Q43: Which of the following is not a

Q44: AASB 123 Borrowing Costs defines a qualifying

Q45: Which of the following statements is correct

Q46: Common examples of qualifying assets are assets

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents