Creed Ltd and Nickleback Ltd enter into a contractual agreement to form a jointly controlled operation on 1 July 2005.Creed Ltd is to contribute land and equipment and Nickleback Ltd agrees to contribute $8 million.It is agreed that they will share output,assets,and future contributions in the ratio 60:40 (Creed.Nickleback) .The contribution by Creed Ltd has an agreed fair value of $9 million for the land and $3 million for the equipment.The book value of the land is $8 million and the net book value of the machinery is $2 million. What are the entries to record the formation of the joint venture operation in the books of Creed Ltd and Nickleback Ltd?

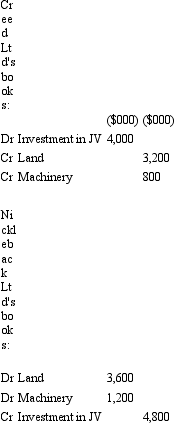

A)

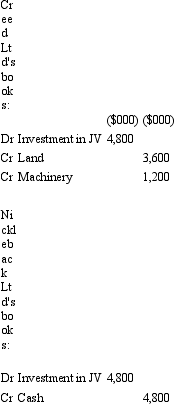

B)

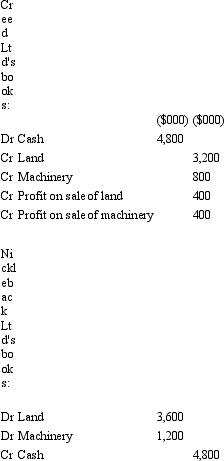

C)

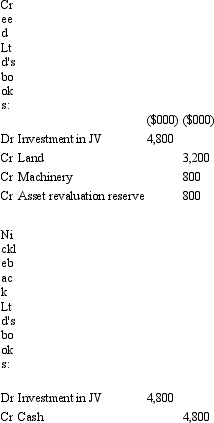

D)

E) None of the given answers.

Correct Answer:

Verified

Q25: Where a joint venture is a partnership:

A)

Q26: The term 'associate' as used in AASB

Q27: A jointly controlled operation:

A) Is a jointly

Q28: A concern raised by opponents to the

Q29: AASB 131 requires that contingent liabilities:

A) Arising

Q31: Go Ltd,For Ltd and It Ltd contractually

Q32: The accounting method required for jointly controlled

Q33: Bush Ltd and Forest Ltd enter into

Q34: Where an asset contributed to a joint

Q35: A joint venture is defined in AASB

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents