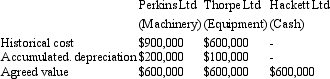

On 30 June 2013,Perkins Ltd,Thorpe Ltd and Hackett Ltd entered into a joint venture operation to produce apparel and related products for the Australian national swimming team.The venturers equally share in output and costs.On the same date,the recorded amounts of each venturer's contributions are as follows:  Assume that agreed values equal recoverable amount and no revaluations have occurred.

Assume that agreed values equal recoverable amount and no revaluations have occurred.

Which of the following combinations correctly indicates the effects on the statement of financial position and statement of financial performance of Hackett Ltd,respectively,after processing the journal entries to account for this joint venture arrangement?

A) No change; No change;

B) Asset increase; Profit increase

C) Asset decrease; Profit decrease.

D) Asset increase; Profit increase.

E) Asset decrease; Profit decrease

Correct Answer:

Verified

Q43: Which of the following statements is not

Q44: Disclosure requirements for jointly controlled operations,according to

Q45: On 30 June 2013,Perkins Ltd,Thorpe Ltd and

Q46: A venturer that recognises in its financial

Q47: AASB 131 requires a venturer to disclose

Q49: Tubular Ltd and Bells Ltd enter into

Q50: Which of the following statements is in

Q51: When accounting for a jointly controlled operation,and

Q52: Which of the following statements about jointly

Q53: AASB 131 requires which of the following

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents