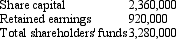

Hip Hop Ltd acquired a 30 per cent interest in Rock Ltd on 1 July 2004 for a cash consideration of $984,000.Rock Ltd's assets and liabilities were recorded at fair value at the time of purchase and were represented by equity as follows:  Additional information relating to the period ended 30 June 2006:

Additional information relating to the period ended 30 June 2006:

The opening balance of Rock's retained earnings was $1,100,000.Rock Ltd had paid a dividend out of pre-acquisition profits of $80,000 during the 2003/2004 period.

Rock Ltd had an after-tax profit of $260,000 for the 2004/2005 period.

Rock Ltd declared an $80,000 dividend out of post-acquisition profits.This dividend will not be paid until the following period.

Hip Hop Ltd accrues the dividends of associates as revenue when they are proposed.What is the amount of the investment in Rock Ltd and the income that will be recorded in the books of Hip Hop Ltd as at 30 June 2006 under (i) the cost method and (ii) the equity method?

A) (i) Investment: $960,000; IncomE. $24,000 (ii) Investment: $1,092,000; IncomE. $78,000

B) (i) Investment: $960,000; IncomE. $24,000 (ii) Investment: $1,068,000; IncomE. $78,000

C) (i) Investment: $984,000; IncomE. $0 (ii) Investment: $1,068,000; IncomE. $24,000

D) (i) Investment: $936,000; IncomE. $48,000 (ii) Investment: $1,014,000; IncomE. $78,000

E) None of the given answers.

Correct Answer:

Verified

Q24: An equity instrument is defined as:

A) An

Q25: AASB 128 specifically addresses the accounting for

Q26: AASB 128 requires that where an investor

Q27: Factors that should be considered in determining

Q28: Equity accounting is argued to provide:

A) A

Q30: Under the equity method of accounting,the amount

Q31: The treatment of equity investments depends on

Q32: Businesses invest in the marketable securities of

Q33: Which of the following are categories that

Q34: Dixie Ltd acquired a 20 per cent

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents