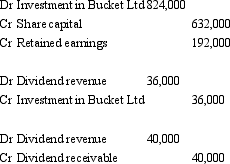

Mop Ltd acquired a 40 per cent interest in Bucket Ltd on 1 July 2004 for a cash consideration of $824,000.Bucket Ltd's assets and liabilities were recorded at fair value at the time of purchase and were represented by equity as follows:  Additional information relating to the period ended 30 June 2005:

Additional information relating to the period ended 30 June 2005:

Bucket Ltd had an after-tax profit of $665,000.

Bucket Ltd proposed a dividend out of pre-acquisition profits of $90,000.

Later in the period Bucket Ltd paid the $90,000 dividend and declared a further $100,000 dividend out of post-acquisition profits.This dividend will not be paid until the following period.

Mop Ltd accrues the dividends of associates as revenue when they are proposed.The investment has been recorded in Mop's books in accordance with the cost method.What consolidation journal entries are required to apply the equity accounting method for the period ended 30 June 2005?

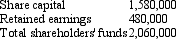

A)

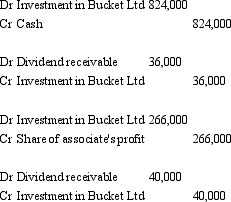

B)

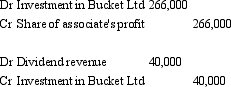

C)

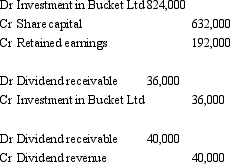

D)

E) None of the given answers.

Correct Answer:

Verified

Q49: In applying equity accounting,dividends received from an

Q50: AASB 128 requires that the investor's share

Q51: Bee Ltd acquired a 40 per cent

Q52: Two years after Voss Limited acquired a

Q53: Which of the following is(are)not a financial

Q55: Quartermain Limited has the following investments: Christian

Q56: Which of the following is not a

Q57: Investments are commonly classified into the following

Q58: In determining the existence of 'significant influence',and

Q59: Quartermain Limited has the following investments: Christian

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents