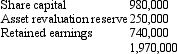

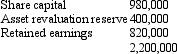

Window Ltd acquired a 70 per cent interest in Door Ltd on 1 July 2003 for a cash consideration of $1,399,000.At that date fair value of the net assets of Door Ltd were represented by:  On 1 July 2004 Window Ltd purchased a further 30 per cent of the issued capital of Door Ltd for cash consideration of $665,000.At this date the fair value of the net assets of Door Ltd were represented by:

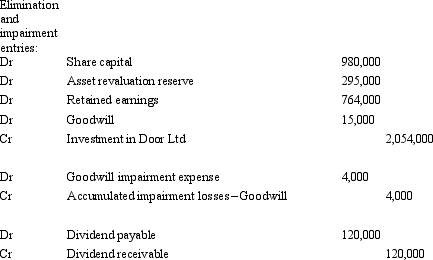

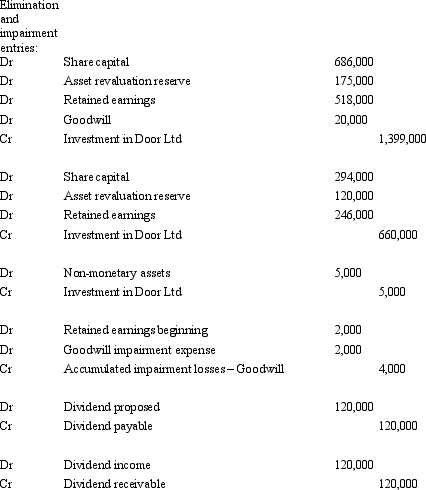

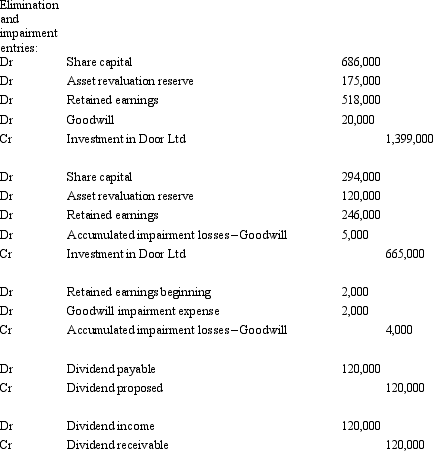

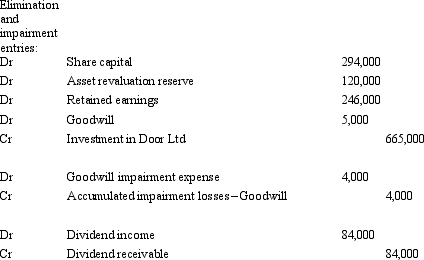

On 1 July 2004 Window Ltd purchased a further 30 per cent of the issued capital of Door Ltd for cash consideration of $665,000.At this date the fair value of the net assets of Door Ltd were represented by: Impairment of goodwill was assessed at $4,000; relating evenly across each of the last two years.During the period ended 30 June 2005,Door Ltd proposed a dividend of $120,000.The dividend has not been paid at the end of the period,but Window Ltd has a policy of accruing the dividends of subsidiaries when they are proposed.There were no other intragroup transactions.What are the consolidation entries to eliminate the investment in the subsidiary,account for goodwill and eliminate the dividends for the period ended 30 June 2005?

Impairment of goodwill was assessed at $4,000; relating evenly across each of the last two years.During the period ended 30 June 2005,Door Ltd proposed a dividend of $120,000.The dividend has not been paid at the end of the period,but Window Ltd has a policy of accruing the dividends of subsidiaries when they are proposed.There were no other intragroup transactions.What are the consolidation entries to eliminate the investment in the subsidiary,account for goodwill and eliminate the dividends for the period ended 30 June 2005?

A)

B)

C)

D)

E) None of the given answers.

Correct Answer:

Verified

Q21: Fan Ltd acquired a 60 per cent

Q22: AASB 3 specifies that where a parent

Q23: Fish Ltd acquired an 80 per cent

Q24: Star Trek Ltd acquires shares in Vulcan

Q25: Hill Ltd acquired an 80 per cent

Q27: Dolly Ltd acquired a 60 per cent

Q28: An immediate parent entity may purchase shares

Q29: Which of the following statements is in

Q30: Fish Ltd acquired an 80 per cent

Q31: On 1 July 2004,Horse Ltd acquired 80

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents