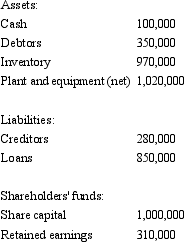

On 1 July 2002,City Ltd acquired 65 per cent of the issued capital of Town Ltd for $850,000 when the fair value of the net assets of Town Ltd was $1.2 million (share capital $1 million and retained earnings $0.2 million) .On 30 June 2005 City Ltd purchased a further 25 per cent of Town's issued capital for $300,000.The net assets of Town Ltd were not stated at fair value in the accounts,which are summarised as follows:  The fair value of the plant and equipment is $1,090,000 at year end.Goodwill has been deemed not to have been impaired.There were no inter-company transactions during the period.

The fair value of the plant and equipment is $1,090,000 at year end.Goodwill has been deemed not to have been impaired.There were no inter-company transactions during the period.

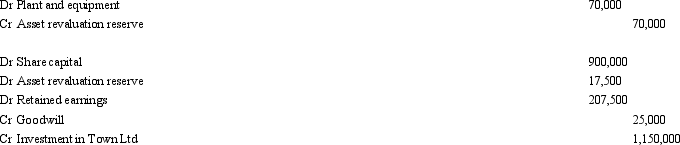

What are the consolidation journal entries required for the period ended 30 June 2005? (Ignore the tax effect of the revaluation)

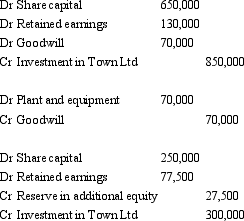

A)

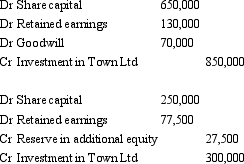

B)

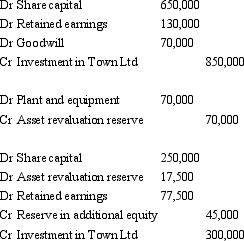

C)

D)

E) None of the given answers.

Correct Answer:

Verified

Q29: Which of the following statements is in

Q30: Fish Ltd acquired an 80 per cent

Q31: On 1 July 2004,Horse Ltd acquired 80

Q32: Which of the following is not a

Q33: Spock Ltd acquired a 10 per cent

Q34: Mickey Ltd acquired a 70 per cent

Q35: The profit or loss on the sale

Q37: The profit or loss on the sale

Q38: Which of the following is not a

Q39: Spock Ltd acquired a 10 per cent

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents