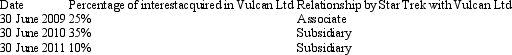

Star Trek Ltd acquires shares in Vulcan Ltd at various stages summarised as follows:  Which of the following statements is not? in accordance with AASB 127 "Consolidated Financial Statements"?

Which of the following statements is not? in accordance with AASB 127 "Consolidated Financial Statements"?

A) Recognise goodwill (bargain gain on purchase) on the acquisition of shares purchased in 2010 and 2011 on consolidation of financial statements for the year 2010 and 2011, respectively, when Star Trek Ltd has control of Vulcan Ltd.

B) Recognise goodwill (bargain gain on purchase) on acquisition of shares made in 2010, when Star Trek Ltd ultimately gained control of the equity of Vulcan Ltd.

C) Difference between purchase consideration and net identifiable assets of Vulcan Ltd for share interests acquired in 2011 is taken to equity.

D) Star Trek Ltd should recognize goodwill using single-date method.

E) None of the given answers.

Correct Answer:

Verified

Q19: Once control over a subsidiary has been

Q19: When additional shares in a subsidiary are

Q21: Fan Ltd acquired a 60 per cent

Q22: AASB 3 specifies that where a parent

Q23: Fish Ltd acquired an 80 per cent

Q25: Hill Ltd acquired an 80 per cent

Q26: Window Ltd acquired a 70 per cent

Q27: Dolly Ltd acquired a 60 per cent

Q28: An immediate parent entity may purchase shares

Q29: Which of the following statements is in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents