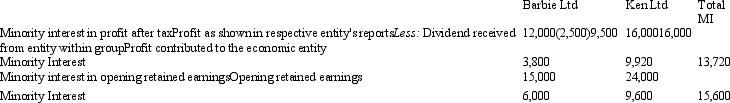

The following is an extract from the minority interest memorandum,used to calculate minority interests.Both subsidiaries became members of the economic entity at the same time at the start of this current period.  The line item 'Dividend received from entity within the group' is an adjustment made:

The line item 'Dividend received from entity within the group' is an adjustment made:

A) to prevent double-counting as the indirect minority interest of Barbie Ltd is in fact the same interest as the direct minority interest in Ken Ltd; and would have already received a share of the dividend as part of the share of profit in Ken Ltd.

B) to recognise, and eliminate, the dividend paid by Barbie Ltd directly to the parent entity.

C) to prevent double-counting as the indirect minority interest of Ken Ltd is in fact the same interest as the direct minority interest in Barbie Ltd; and would have already received a share of the dividend as part of the share of profit in Ken Ltd

D) to recognise, and eliminate, the dividend paid by Ken Ltd directly to the parent entity.

E) None of the given answers.

Correct Answer:

Verified

Q17: The order of acquisition of subsidiaries (i.e.,sequential

Q18: The non-controlling interest in post-acquisition capital and

Q19: In calculating indirect minority interests,intragroup transactions need

Q20: The elimination of the parent entity's investment

Q21: The following acquisition analysis relates to a

Q23: The following acquisition analysis relates to a

Q24: The following diagram represents the ownership of

Q25: The following is an extract from the

Q26: Rose Ltd acquired a 75 per cent

Q27: The following diagram represents the ownership of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents