Little Company declared a dividend of $90,000 for the period ended 30 June 2005.Big Company owns 100 per cent of the equity of Little Company.Big Company accrues dividends when they are declared by its subsidiaries.What elimination entry would be required to prepare the consolidated financial statements for the group for the period ended 30 June 2005?

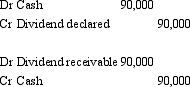

A)

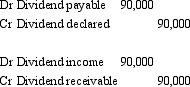

B)

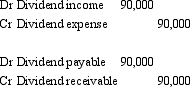

C)

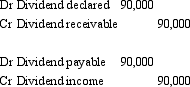

D)

E) None of the given answers.

Correct Answer:

Verified

Q1: Parent Ltd sells inventories to Child Ltd

Q2: Intragroup profits are eliminated in consolidation to

Q5: In the absence of an election to

Q6: Dividends paid between entities in the group

Q7: AASB 127 "Consolidated and Separate Financial Statements"

Q8: Examples of intragroup transactions include:

A) Dividends payable

Q10: Intragroup transactions that are to be eliminated

Q11: AASB 127 "Consolidated and Separate Financial Statements"

Q14: Company A owns 51 per cent of

Q16: The value of inventory on hand for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents