Stormy Ltd has purchased all the issued capital of Cloud Ltd at the beginning of the current period.At the end of the period Cloud Ltd declares a dividend of $50,000 that is identified as being paid out of pre-acquisition profits.What entries would Stormy Ltd and Cloud Ltd make in their own books? (Assume Stormy Ltd accrues the dividends of subsidiaries when they are declared.)

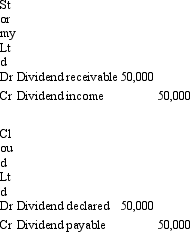

A)

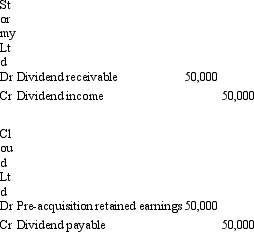

B)

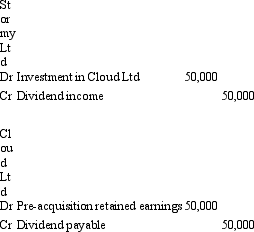

C)

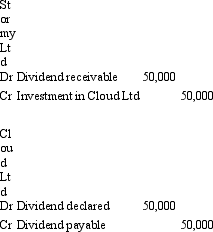

D)

E) None of the given answers.

Correct Answer:

Verified

Q34: Monster Co Ltd owns 100 per cent

Q35: Which of the following statements describes the

Q36: What is the amount of unrealised profit

Q37: French Ltd purchased 100 per cent of

Q38: Radio Ltd acquired all the issued capital

Q40: A non-current asset was sold by Subsidiary

Q41: Alice Ltd sold inventory items to its

Q42: Woody Ltd sold inventory items to its

Q43: Lilo Ltd sells inventory items to its

Q44: Penny Ltd sells inventory items to its

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents