Belgium Ltd owns all the issued capital of Chocolate Ltd.During the period ended 30 June 2005 Belgium Ltd sold Chocolate Ltd inventory that had a cost of $200,000 for $270,000.At the end of the current period Chocolate Ltd had 75 per cent of that inventory still on hand; the rest was sold to entities external to the group.During the previous period Chocolate Ltd had sold inventory to Belgium Ltd at a profit of $49,000.At the end of that period (30 June 2004) Belgium Ltd still had 40 per cent of that inventory on hand.That entire inventory was sold to parties external to the group during the current year.The taxation rate is 30 per cent and both companies use a perpetual inventory system. What consolidation journal entries are required to eliminate the effects of these transactions for the period ended 30 June 2005?

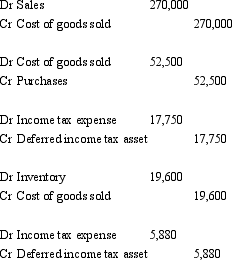

A)

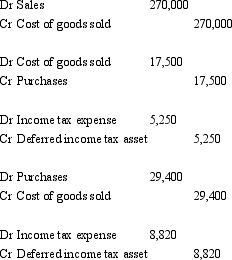

B)

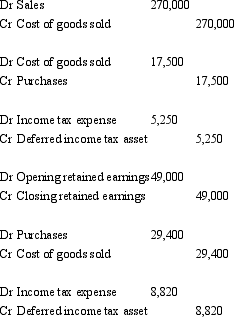

C)

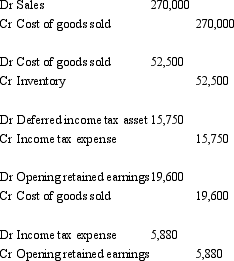

D)

E) None of the given answers.

Correct Answer:

Verified

Q22: Companies A,B and C are all part

Q23: French Ltd owns 100 per cent of

Q24: What is the amount of unrealised profit

Q25: Hammer Ltd acquired all the issued capital

Q26: The journal entries to eliminate unrealised profit

Q28: A non-current asset was sold by Subsidiary

Q29: The treatment of dividends,paid by a subsidiary,that

Q30: Companies A,B and C are all part

Q31: Meat Ltd purchased 100 per cent of

Q32: Zeus Ltd owns 100 per cent of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents