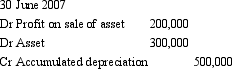

A non-current asset was sold by Subsidiary Limited to Parent Limited during the 2006-07 financial year.The carrying amount of the asset at the time of the sale was $700,000.As part of the consolidation process,the following journal entry was passed.  What (a) amount did Parent Limited pay Subsidiary Limited for the asset; (b) was the cost of the asset as shown in the books of Subsidiary Limited?

What (a) amount did Parent Limited pay Subsidiary Limited for the asset; (b) was the cost of the asset as shown in the books of Subsidiary Limited?

A) (a) $900,000; (b) $1,400,000

B) (a) $900,000; (b) $1,200,000.

C) (a) $700,000; (b) $1,200,000

D) (a) $900,000; (b) $800,000

E) Cannot determine from the information provided.

Correct Answer:

Verified

Q35: Which of the following statements describes the

Q36: What is the amount of unrealised profit

Q37: French Ltd purchased 100 per cent of

Q38: Radio Ltd acquired all the issued capital

Q39: Stormy Ltd has purchased all the issued

Q41: Alice Ltd sold inventory items to its

Q42: Woody Ltd sold inventory items to its

Q43: Lilo Ltd sells inventory items to its

Q44: Penny Ltd sells inventory items to its

Q45: Aladdin Ltd sold inventory items (with a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents