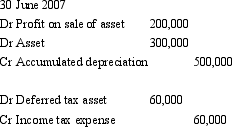

A non-current asset was sold by Subsidiary Limited to Parent Limited on 30 June 2007.The carrying amount of the asset at the time of the sale was $700,000.As part of the consolidation process,the following journal entry was passed.  Assuming there is another ten years of useful life remaining for the asset,what are the journal entries at 30 June 2009 to adjust for depreciation?

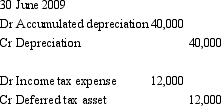

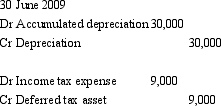

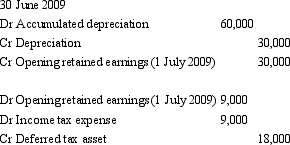

Assuming there is another ten years of useful life remaining for the asset,what are the journal entries at 30 June 2009 to adjust for depreciation?

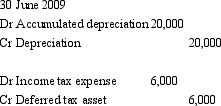

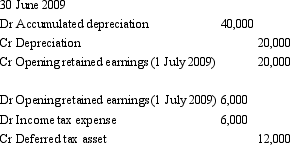

A)

B)

C)

D)

E)

Correct Answer:

Verified

Q23: French Ltd owns 100 per cent of

Q24: What is the amount of unrealised profit

Q25: Hammer Ltd acquired all the issued capital

Q26: The journal entries to eliminate unrealised profit

Q27: Belgium Ltd owns all the issued capital

Q29: The treatment of dividends,paid by a subsidiary,that

Q30: Companies A,B and C are all part

Q31: Meat Ltd purchased 100 per cent of

Q32: Zeus Ltd owns 100 per cent of

Q33: Large Company owns 80 per cent of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents