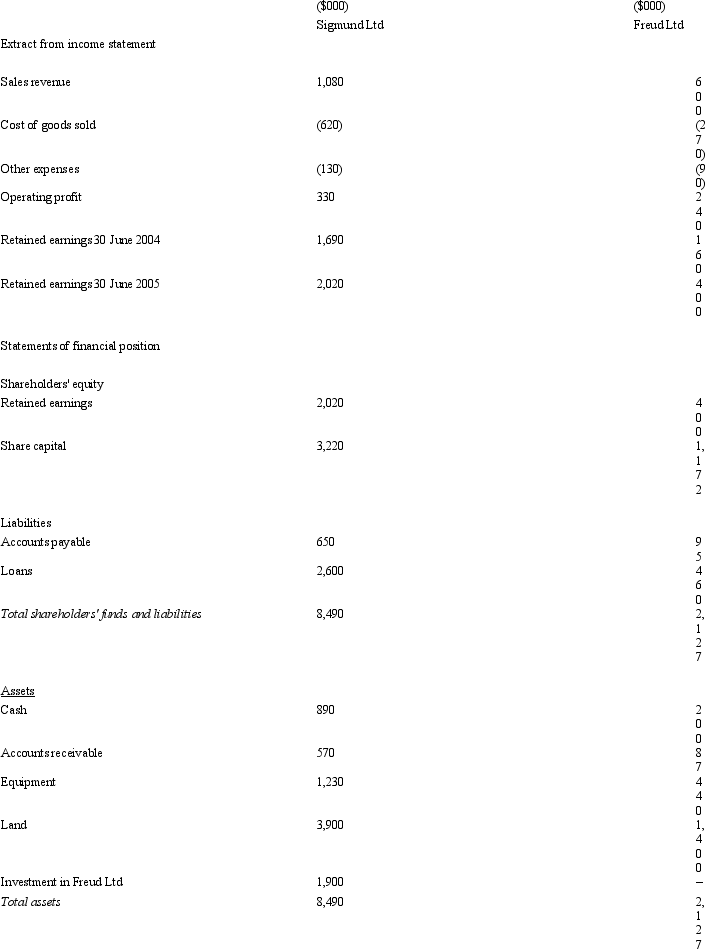

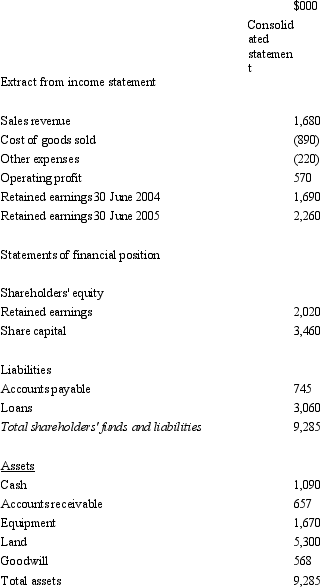

Sigmund Ltd acquires all the issued capital of Freud Ltd for a cash payment of $1,900,000 on 30 June 2004.The financial statements of both entities on 30 June 2005 are:  The fair value of the net tangible assets of Freud Ltd on 30 June 2004 was $1,332,000.The equity of Freud at that time was made up of share capital of $1,172,000 and retained earnings of $160,000.Goodwill had been determined to have been impaired by $56,800 during the period.During the period ended 30 June 2005 there were no intragroup transactions.Which of the following consolidated financial statements is correct?

The fair value of the net tangible assets of Freud Ltd on 30 June 2004 was $1,332,000.The equity of Freud at that time was made up of share capital of $1,172,000 and retained earnings of $160,000.Goodwill had been determined to have been impaired by $56,800 during the period.During the period ended 30 June 2005 there were no intragroup transactions.Which of the following consolidated financial statements is correct?

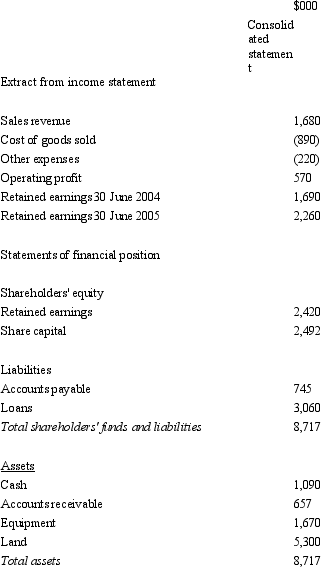

A)

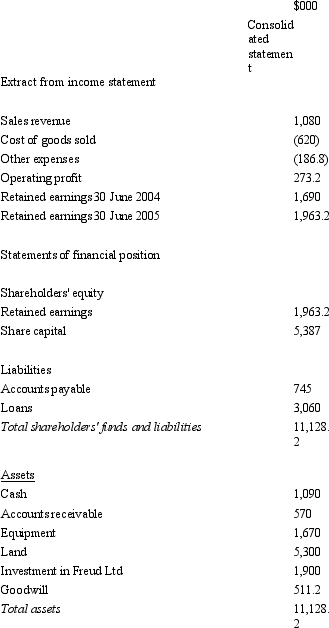

B)

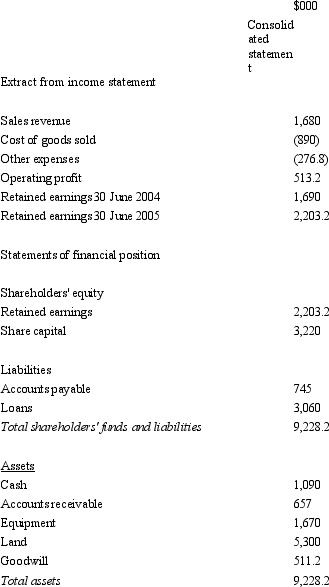

C)

D)

E) None of the given answers.

Correct Answer:

Verified

Q50: In a situation where the net assets

Q51: Candle Ltd acquires all the issued capital

Q52: A former loophole (now closed)that existed under

Q53: 'Control' exists when the parent owns less

Q54: Which of the following statements is not

Q56: Minority interests are defined is AASB 127

Q57: Where the controlled entity's non-current assets were

Q58: 'Goodwill' is:

A) an intangible asset, as defined

Q59: In determining control,'potential voting rights':

A) include those

Q60: Fresco Ltd acquires all the issued capital

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents