Gingimup Ltd purchased all the equity of Kindawansa Ltd on 30 June 2005.At that time the carrying value of the net assets of Kindawansa was $1,200,000.This amount was made up in equity as follows: share capital $1,000,000; retained earnings $200,000.Kindawansa has held some valuable land for a long time (purchased at $ 1,200,000) ,but has not revalued it.Its fair value at 30 June 2005 was $2,800,000 (all other non-current assets are recorded at fair value) .Gingimup Ltd paid cash consideration of $3,000,000 for Kindawansa Ltd.Assuming that the land has not been revalued in the controlled entity's books,what are the elimination entries required to reflect the purchase of Kindawansa Ltd?

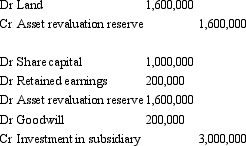

A)

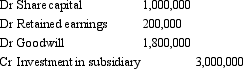

B)

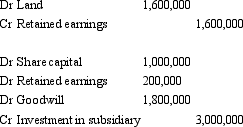

C)

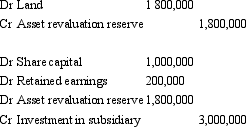

D)

E) None of the given answers.

Correct Answer:

Verified

Q38: One important aim of releasing AAS 24

Q39: In the situation in which a subsidiary

Q40: Growl Ltd acquires all the issued capital

Q41: Banderas Ltd acquires all the issued capital

Q42: Which of the following statements accurately describes

Q44: The preparation of consolidated financial statements:

A) obviates

Q45: The lack of a direct link between

Q46: In the situation in which a subsidiary

Q47: A subsidiary:

A) is excluded from consolidation because

Q48: Arthur Ltd acquires all the issued capital

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents