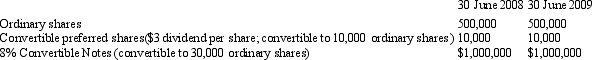

Tucson Ltd reported a net income after tax of $2,850,000 for the year ended 30 June 2009.The capital structure of Tucson Ltd follows:  Tucson Ltd paid its preference shareholders during the year and there are non dividends in arrears.All potential ordinary shares were outstanding on 1 July 2008.

Tucson Ltd paid its preference shareholders during the year and there are non dividends in arrears.All potential ordinary shares were outstanding on 1 July 2008.

The company's tax rate is 30%.

In accordance with AASB 133,the basic earnings per share and diluted earnings per share for Tucson Ltd should be:

A) $5.64; $5.48.

B) $5.64; $5.44.

C) $5.70; $5.44.

D) $5.70; $5.48.

E) None of the given answers.

Correct Answer:

Verified

Q24: Nogales Ltd is planning to raise $100

Q25: In order to determine whether or not

Q26: In accordance with AASB 113,which of the

Q27: Under which of the following situations would

Q28: Dormant Ltd has a net income after

Q30: Awake Ltd has a net income after

Q31: Gimlet Ltd has earnings after tax of

Q32: For the purpose of calculating dilutive earnings

Q33: On a 1 July 2006,Mayorga Ltd has

Q34: In accordance with AASB 133,which of the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents