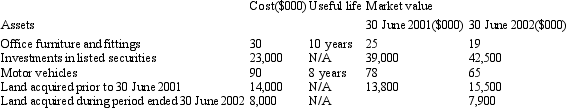

Happy Days Superannuation Plan provides the following information regarding its assets and receipts for the year ended 30 June 2002:  During the period land acquired before 30 June 2001 was sold.The land had a cost of $4 million,a market value at 30 June 2001 of $4.5 million,and was sold for $6 million.What is the revenue of the superannuation plan for the period in accordance with AAS 25?

During the period land acquired before 30 June 2001 was sold.The land had a cost of $4 million,a market value at 30 June 2001 of $4.5 million,and was sold for $6 million.What is the revenue of the superannuation plan for the period in accordance with AAS 25?

A) $12,600,000

B) $6,585,750

C) $11,081,000

D) $6,581,000

E) None of the given answers.

Correct Answer:

Verified

Q27: The requirements of AAS 25 mean that

Q28: A defined benefit plan is one in

Q29: Long-lived Superannuation Plan provides the following information

Q30: In the case of a defined benefit

Q31: A defined contribution plan is one in

Q33: The measurement of the accrued benefits of

Q34: What is the key distinction between a

Q35: AAS 25's argument in support of its

Q36: How are the accrued benefits of a

Q37: Situations in which a superannuation plan may

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents