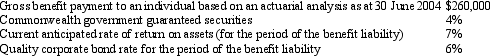

Maestro Superannuation Plan provides the following information relating to the period ended 30 June 2004:  The actuarial assumption used to calculate the liability was that the individual would take the benefit as a lump sum on retirement in 9 years' time.What is the present value of the expected future benefit payment (rounded to the nearest dollar) ?

The actuarial assumption used to calculate the liability was that the individual would take the benefit as a lump sum on retirement in 9 years' time.What is the present value of the expected future benefit payment (rounded to the nearest dollar) ?

A) $153,894

B) $182,673

C) $141,423

D) $39,907

E) None of the given answers.

Correct Answer:

Verified

Q42: Revenues of superannuation plans include:

A) Investment revenue.

B)

Q43: The following information relates to the Retiree's

Q44: Do-it-Yourself Defined Contribution Plan owns the following

Q45: The accounting treatment for the sale of

Q46: The following information relates to the Montigo

Q48: The assets of a superannuation fund include:

A)

Q49: Which of the following items is not

Q50: The disclosure requirements for a defined contribution

Q51: Which of the following statement(s)is/are correct?

A) AAS

Q52: AAS 25 requires a defined benefit plan

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents