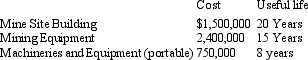

On 1 April 2008,Ulladulla Mining Ltd assessed that its Mollymook area of interest contained economically recoverable reserves of 50,000 ounces of gold.On the same day the entity installed the following assets:  The above assets were ready for use on 1 July 2008.Ulladulla Mining Ltd expects to extract the entire reserves in 5 years.For the year ending 30 June 2009 the entity had extracted 5,000 ounces of gold.

The above assets were ready for use on 1 July 2008.Ulladulla Mining Ltd expects to extract the entire reserves in 5 years.For the year ending 30 June 2009 the entity had extracted 5,000 ounces of gold.

What is the total depreciation/amortisation expense for the capitalised development costs for the year ending 30 June 2008?

A) $465,000

B) $483,750

C) $540,000

D) $930,000

E) None of the given answers.

Correct Answer:

Verified

Q50: AASB 6 requires the separate disclosure of:

A)

Q51: AASB 6 requires disclosure of information that

Q52: Which of the following costs is not

Q53: Which of the following statement(s)is/are correct?

A) Entities

Q54: If an area-of interest is abandoned,which of

Q55: On 1 July 2002 Honies Ltd commenced

Q57: Disclosures related to restoration costs:

A) Are not

Q58: Since the late 1980s,an increasing number of

Q59: On 1 April 2008,Ulladulla Mining Ltd assessed

Q60: On 1 July 2002 Brumbles Ltd commenced

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents