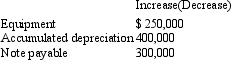

Swans Machinery Ltd reported a net profit of $3,000,000 for the year ended 30 June 2009.The following changes occurred in the balance sheet:  Additional information:

Additional information:

During the year Swans Ltd sold equipment with a cost of $250,000 and had accumulated depreciation of $120,000 for a gain of $50,000.

On 30 June 2009 Swans Ltd purchased equipment costing $500,000 with $200,000 in cash and a note payable for $300,000.

Depreciation expense for the year was $520,000

What is the amount of net cash from operating activities and net cash used in investing activities,respectively for the year ended 30 June 2009?

A) $3,470,000; ($20,000) ;

B) $3,520,000; ($20,000) ;

C) $3,470,000; (200,000) ;

D) $3,520,000; ($500,000) ;

E) None of the given answers.

Correct Answer:

Verified

Q43: What is net cash used in financing

Q44: Saints Ltd is preparing a statement of

Q45: The following information is provided for Unique

Q46: Which combination is the appropriate operation to

Q47: Sonic Co Ltd provides the following information

Q49: The following are cash flow transactions for

Q50: Which of the following statements is correct

Q51: Heady Ltd provides the following information for

Q52: Lions Ltd engaged in the following activities

Q53: The following are cash flow transactions for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents