Partridge Ltd holds a well-diversified portfolio of shares with a current market value on 1 April 2004 of $1 million.On this date Partridge Ltd decides to hedge the portfolio by taking a sell position in fifteen SPI futures units.The All Ordinaries SPI is 3130 on 1 April 2004.A unit contract in SPI futures is priced based on All Ordinaries SPI and a price of $25.The futures broker requires a deposit of $80,000.On 30 June the All Ordinaries SPI has fallen to 2,980 and the value of the company's share portfolio has fallen to $950,000.What are the appropriate journal entries to record these events?

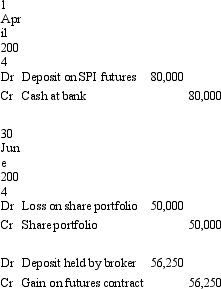

A.

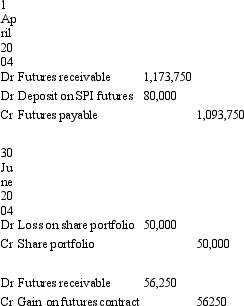

B.

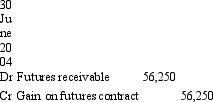

C.

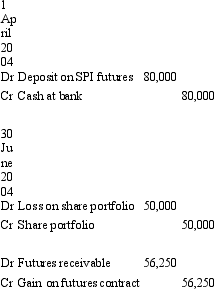

D.

E. None of the given answers.

Correct Answer:

Verified

Q26: In differentiating between a financial liability and

Q27: AASB 132 defines a financial instrument as:

A.

Q28: Golden Doors enters into a forward exchange

Q29: Which of the following are examples of

Q30: Penitent Ltd acquired a parcel of 10,000

Q32: A derivative financial instrument is one which:

A.

Q33: According to AASB 132,which of the following

Q34: The characteristics of a swap agreement may

Q35: Which of the following are examples of

Q36: What is hedging?

A. It is a method

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents