Partridge Ltd holds a well-diversified portfolio of shares with a current market value on 1 April 2004 of $1 million.On this date Partridge Ltd decides to hedge the portfolio by taking a sell position in fifteen SPI futures units.The All Ordinaries SPI is 3,130 on 1 April 2004.A unit contract in SPI futures is priced based on All Ordinaries SPI and a price of $25.The futures broker requires a deposit of $80,000.On 30 June the All Ordinaries SPI has fallen to 2,980 and the value of the company's share portfolio has fallen to $950,000.On 1 July 2004 Partridge Ltd decides to sell its shares and close out its futures contract.At this date the portfolio has a market value of $925,000 and the All Ordinaries SPI is 2,900.Assume all entries have been made to mark to market the futures contract and record changes in the deposit up to 1 July.What are the entries to record the transactions of 1 July 2004 (only)?

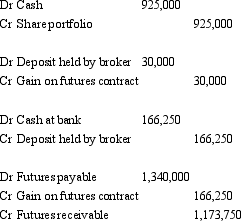

A.

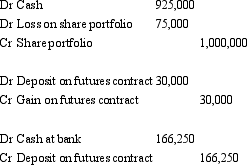

B.

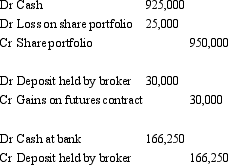

C.

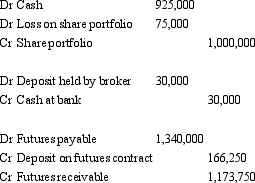

D.

E. None of the given answers.

Correct Answer:

Verified

Q33: According to AASB 132,which of the following

Q34: The characteristics of a swap agreement may

Q35: Which of the following are examples of

Q36: What is hedging?

A. It is a method

Q37: Pigeon Ltd holds a well-diversified portfolio of

Q39: The characteristics of a call option are

Q40: Jackson Ltd has a US$50,000 receivable due

Q41: AASB 139 stipulates how financial instruments are

Q42: Sampras Ltd issued $20 million of convertible

Q43: An attribute of an equity instrument is:

A.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents