On 31 October 2012 DGC Investment Ltd purchased a well diversified portfolio of shares that it is intending to sell in three months time.To hedge against the adverse movements in price of these shares,on the same date,the manager obtained four "sell" contracts with DSI Futures.A deposit of $20,000 was required by the broker for the futures contract.A standard futures contract is $25 per basis point.

On 31 January 2013,DGC Investment Ltd sold the portfolio and closed out all four contracts.

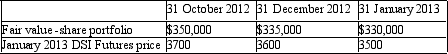

The following information is provided.

What is the financial effect of the above transactions on the statement of comprehensive income of DGC Investment Ltd for the reporting period ending 31 December 2012,respectively?

What is the financial effect of the above transactions on the statement of comprehensive income of DGC Investment Ltd for the reporting period ending 31 December 2012,respectively?

A. Decrease by $5 000;

B. Decrease by $15 000;

C. Increase by $5 000;

D. Increase by $10 000;

E. No effect; No effect.

Correct Answer:

Verified

Q57: For a financial instrument to be classified

Q58: Two companies enter into loan agreements on

Q59: What is the appropriate accounting treatment for

Q60: Prepayments are:

A. Not financial instruments because they

Q61: Which of the following items is not

Q63: The carrying amount of a financial 'held-to-maturity'

Q64: David Ltd acquired a parcel of 50

Q65: Documentation that constitutes a financial instrument as

Q66: In disclosing information about how a financial

Q67: The following journal entry pertains to convertible

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents