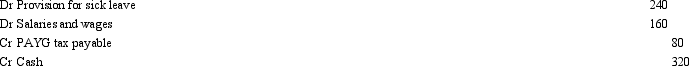

The following journal entry accounts for one week's (five days) salaries and wages for an employee:  Which of the following statements is(are) correct?

Which of the following statements is(are) correct?

A) That the employee's gross salary is $400 per week.

B) That the employee was absent from work for 3 days during the week and was paid for his/her absence.

C) That the employee's bank account is credited with an amount of $320 for his/her week's work.

D) That the PAYG tax rate for this employee is 20 per cent.

E) All of the given answers.

Correct Answer:

Verified

Q49: Post-employment benefits include:

A) Cash payments.

B) Pensions payable

Q50: A non-contributory superannuation fund means:

A) No contributions

Q51: In Australia,employee entitlements are protected in the

Q52: Entity A contributes to a defined benefit

Q53: Junior Ltd employs three workers to develop

Q55: The expense recognised by an employer for

Q56: Junior Ltd employs three workers to develop

Q57: AASB 119 defines 'employee benefits' as:

A) Salaries

Q58: Trailers of the World has a small

Q59: When salaries and wages are capitalised as

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents