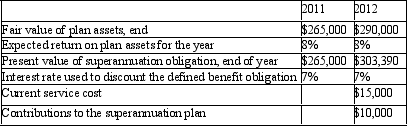

Whitsunday Ltd provides defined superannuation benefits to two (2) of its employees which represents an entitlement of three times their final salary on retirement.The following details are relevant to the current superannuation obligation of the company for the two employees for the years ended 30 June 2011 and 2012:  In accordance with AASB 119 "Employee Benefits",what is the expected return and actuarial gain (loss) for the plan assets for the year ending 2012,respectively?

In accordance with AASB 119 "Employee Benefits",what is the expected return and actuarial gain (loss) for the plan assets for the year ending 2012,respectively?

A) $21 200; $6 200

B) $21 200; ($6 200)

C) $23 200; $8 200

D) $23 200; ($8 200)

E) None of the given answers

Correct Answer:

Verified

Q57: AASB 119 defines 'employee benefits' as:

A) Salaries

Q58: Trailers of the World has a small

Q59: When salaries and wages are capitalised as

Q60: Midrift Ltd has nine employees who are

Q61: Great Keppel Ltd provides defined superannuation benefits

Q62: Mackay Ltd provides defined superannuation benefits to

Q64: Annette French joined Paris Ltd on 1

Q65: Which of the following is ?not considered

Q66: Entity A contributes to a defined benefit

Q67: Entity A contributes to a defined benefit

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents