Nerang Orange Farms Ltd has orange tress which on 30 June 2009 had a fair value of $1,600,000.On 30 April 2010,oranges with an estimated market value of $300,000 were picked.The costs of picking,sorting and packing paid in cash amount to $150,000.The oranges were sold on the same day for $310,000.An independent valuation on 30 June 2006 report that the estimated fair value of the orange trees is $1,500,000.What is the journal entry to recognise the harvest of oranges on 30 April 2010?

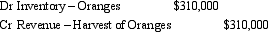

A)

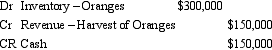

B)

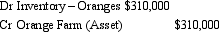

C)

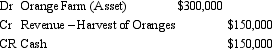

D)

E) None of the given answers.

Correct Answer:

Verified

Q37: Roberts,Staunton and Hagen (1995)propose that biological assets

Q38: Difficulties applying the net present value method

Q39: AASB 141 excludes certain biological assets from

Q40: Arguments for the use of financial valuations

Q41: One approach to revenue recognition proposed for

Q43: Margaret Ltd has a vineyard and at

Q44: AASB 1037 and AASB 141 have been

Q45: Which of the following are within the

Q46: AASB 141 requires biological assets to be

Q47: Which of the following statements is a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents