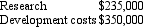

Glass 4 Windows is involved in a research and development project to create a filtering window that removes the need for curtains.For the current year ended 30 June 2004 expenditure on the project is as follows:  The window is expected to earn revenues of $70,000 per year for the 10 years commencing 1 July 2004.Assuming straight-line amortisation,how much of the research and development cost should be expensed this period and what amount should be amortised in the year ended 30 June 2007?

The window is expected to earn revenues of $70,000 per year for the 10 years commencing 1 July 2004.Assuming straight-line amortisation,how much of the research and development cost should be expensed this period and what amount should be amortised in the year ended 30 June 2007?

A) Expensed in 2004: $58,500 Amortisation in 2007: $58,500

B) Expensed in 2004: $235,000 Amortisation in 2007: $35,000

C) Expensed in 2004: $235,000 Amortisation in 2007: $28,000

D) Expensed in 2004: $350,000 Amortisation in 2007: $23,500

E) None of the given answers.

Correct Answer:

Verified

Q3: AASB 138 requires that all intangibles,whether purchased

Q14: The revaluation model requires all intangible assets

Q17: Continuously Contemporary Accounting emphasises an entity's ability

Q19: Examples of intangible assets include:

A) Loyal customers.

B)

Q21: There is a concern that research and

Q23: Earth Ltd acquired Moon Ltd on 1

Q24: Far-flung Co Ltd purchases Local Co Ltd

Q25: Purchased goodwill is recognised as the amount

Q26: An intangible asset may be recorded.

A) If

Q27: Which of the following statements is correct

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents