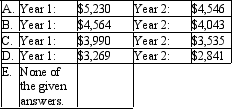

Red Enterprises purchased a vehicle for $35 000.A further $5000 was spent to prepare it for use.The useful life of the vehicle is expected to be 15 years,but Red Enterprises expects to replace it with a better model in 7 years' time.The salvage value is estimated to be $6500 after 15 years and $15 000 at the end of 7 years.What is the depreciation for the first 2 years using the declining-balance method of depreciation (rounded to the nearest dollar)?

Correct Answer:

Verified

Q31: Pentec Ltd has just acquired 5 new

Q32: AASB 116 requires that depreciation be reviewed

A)

Q33: Cutting Edge Ltd purchased a state of

Q34: Yellow Limited purchased an asset 6 years

Q35: Super Industries purchased a new vehicle on

Q37: Where an asset is revalued,the treatment of

Q38: Precious Gems Co purchased a diamond-cutting machine

Q39: Boysone Ltd has constructed a piece of

Q40: Magpie Ltd purchased a building on a

Q41: In light of a company being subject

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents