Percy Ltd has a piece of equipment that has been depreciated for 3 years using the declining-balance depreciation method at a rate of 20 per cent.The equipment cost $34,000 and has a salvage value of $4,000.At the end of the third year the asset is sold for $24,000.What is the appropriate journal entry to record the disposal in line with the requirements of AASB 116?

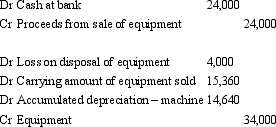

A)

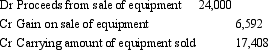

B)

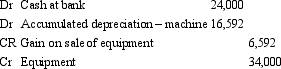

C)

D)

E) None of the given answers.

Correct Answer:

Verified

Q46: Intangible assets are not depreciated under AASB

Q47: In accordance with AASB 116,under the cost

Q48: Crows Ltd purchased a photocopier on 1

Q49: Galway Ltd purchased a computer for $6,000

Q50: Pursuant to AASB 116,what is the carrying

Q52: The company recently acquired factory equipment.Which of

Q53: A company recently ordered a piece of

Q54: AASB 116 requires disclosure of a reconciliation

Q55: Managers of some entities have resisted depreciating

Q56: All Saints Ltd acquired a machine for

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents