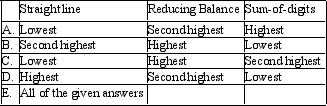

The company has a depreciable asset with a purchase price of $500,000 and an estimated residual of $20,000.The company estimates that the asset will generate future economic benefits for the next 10 years.You are not sure on what depreciation method to adopt but would like to be aware of the effect of using different depreciation methods.Which of the following is correct with respect depreciation expense for Year 1?

Correct Answer:

Verified

Q39: Boysone Ltd has constructed a piece of

Q40: Magpie Ltd purchased a building on a

Q41: In light of a company being subject

Q42: Which of the following statement is applicable

Q43: Priceless Products Ltd purchased some display stands

Q45: A non-current asset has the following information

Q46: Intangible assets are not depreciated under AASB

Q47: In accordance with AASB 116,under the cost

Q48: Crows Ltd purchased a photocopier on 1

Q49: Galway Ltd purchased a computer for $6,000

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents