Golden Co Ltd has donated a vehicle to Bushman Enterprises as a result of publicity about the plight of Bushman Enterprises after bushfires destroyed most of its fleet of vehicles.The vehicle had cost Golden Co $25 000 and has accumulated depreciation of $10 000.Its market value is $20 000.How should the asset transfer be recorded in both companies' books?

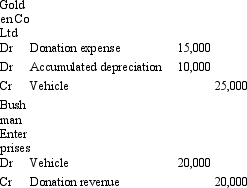

A)

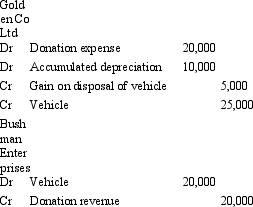

B)

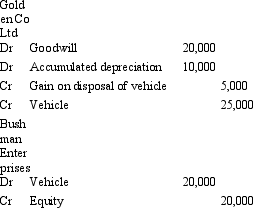

C)

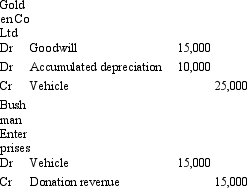

D)

E) None of the given answers.

Correct Answer:

Verified

Q36: AASB 101 requires,as a minimum,certain line items

Q37: Which of the following assets are recognised

Q38: Bruno Enterprises has constructed a heavy weight

Q39: In a previous period Banshee Ltd wrote-off

Q40: AASB 101 indicates that when presenting a

Q42: It is expected that the service potential

Q43: Advertising costs are not typically capitalised because.

A)

Q44: The following measurement bases are acceptable for

Q45: Calling Card Co Ltd has acquired a

Q46: The cost of an asset will typically

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents