During the audit of Keats Island Brewery for the fiscal year-ended June 30,2018,the auditors identified the following issues:

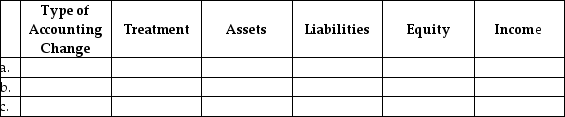

For each of the three issues described below,using the following table,identify both the direction (increase or decrease)and the amount of the effect relative to the amount without the accounting change.

a.The company sells beer for $1 each plus $0.10 deposit on each bottle.The deposit collected is payable to the provincial recycling agency.During 2017,the company had recorded $12,000 of deposits as revenue.The auditors believe this amount should have been recorded as a liability.

b.The company had been using the first-in,first-out cost flow assumption for its inventories.In fiscal 2018,management decided to switch to the weighted-average method.This change reduced inventory by $25,000 at June 30,2017,and $40,000 at June 30,2018.

c.The company has equipment costing $6,000,000 that it has been depreciating over 10 years on a straight-line basis.The depreciation for fiscal 2017 was $600,000 and accumulated depreciation on

June 30,2017,was $1,200,000.During 2018,management revises the estimate of useful life to 12 years,reducing the amount of depreciation to $480,000 per year.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q20: For a company using the straight-line method

Q24: Why is the retrospective approach conceptually appropriate

Q26: Give an example of a change in

Q27: Define "a retrospective adjustment."

Q28: Why are retrospective adjustments to past years'

Q30: Evaluate each of the following independent situations

Q30: How should enterprises reflect changes in accounting

Q33: A retailer increases bad debts expense from

Q37: What are two reasons why an accounting

Q39: For a construction contract where the company

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents