Star Company Ltd.,is a private company that started on January 1,2017.During an external audit that was conducted at the end of the second year of the company's operation (2018),the following information was presented:

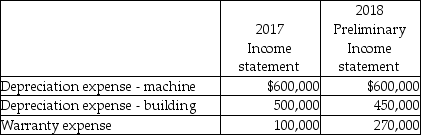

Star Company has one huge machine that cost $6,000,000 and was depreciated over an estimated useful life of 10 years.Upon reviewing the manufacturer's reports in 2018,management now firmly believes the machine will last a total of 15 years from date of purchase.They would like to change last year's depreciation charge based on this analysis.

Star Company has one huge machine that cost $6,000,000 and was depreciated over an estimated useful life of 10 years.Upon reviewing the manufacturer's reports in 2018,management now firmly believes the machine will last a total of 15 years from date of purchase.They would like to change last year's depreciation charge based on this analysis.

The company's building (cost $5,000,000,estimated salvage value $0 useful life 20 years)was depreciated using the 10% declining-balance method.The company and auditor now agree that the straight-line method would be a more appropriate method to use.

Star Company does not accrue for warranties; rather it records the warranty expense when amounts are paid.Star provides a one-year warranty for defective goods.Payments to satisfy warranty claims in 2017 were $100,000,and $270,000 in 2018.Out of the $270,000 paid in 2018,$150,000 related to 2017 sales.A reasonable estimate of warranties payable at the end of 2018 is $275,000.

Required:

a.As the auditor on this engagement,what is your recommended treatment for each of these matters in terms of whether they are errors,changes in accounting policy,changes in estimate? Explain your conclusion.

b.Assume that management of Star Company agrees with your recommendations.How would the balances above be presented in the corrected income statements for 2012 and 2013?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q46: Grant Pharmaceuticals Ltd.undertook a research and development

Q47: Cantac Construction purchased a piece of equipment

Q48: Canlan Inc.is a subsidiary of a Canadian

Q49: Albacore Sailboats manufactures small sailing dinghies.In 2019,the

Q50: On December 15,2017,The Dutton Company factored $1,600,000

Q52: Anfield Corp.is analyzing its accounts receivable for

Q53: CBC Biomedical undertook a research and development

Q54: On June 30,2017,Whiggins Company received $60,000 from

Q55: For each of the following independent scenarios,indicate

Q56: Star Company Ltd.,is a private company that

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents