Canlan Inc.is a subsidiary of a Canadian publicly traded manufacturer of construction materials.The company uses the first-in,first-out (FIFO)cost flow assumption.

a.An invoice for $55,000 of material received and used in production arrived after the year-end.Neither the purchase nor the accounts payable was recorded until year two.However,the amount of raw materials in ending inventory was correct based on the inventory count.

b.One of Canlan's products became obsolete and worthless during Year 1,but the inventory writedown did not occur until Year 2.The cost of this inventory was $225,000.

c.In the Year 1 closing inventory count,employees improperly included 2,000 units of finished goods that had already been sold to customers.These units had a cost of $20,000 under FIFO.

Required:

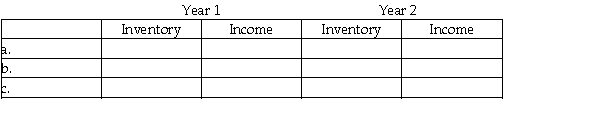

For each of the above independent scenarios (a)through (c),indicate in the following table the effect of the accounting errors on the books of Canlan Inc.Specifically,identify the amount and direction of over- or understatement of inventory and income for Year 1 and Year 2.If an account requires no adjustment,indicate that the account is "correct."

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q43: Pracene Sports Supply is a relatively new

Q44: For each of the following independent scenarios,indicate

Q45: Wasson Company purchased land and a building

Q46: Grant Pharmaceuticals Ltd.undertook a research and development

Q47: Cantac Construction purchased a piece of equipment

Q49: Albacore Sailboats manufactures small sailing dinghies.In 2019,the

Q50: On December 15,2017,The Dutton Company factored $1,600,000

Q51: Star Company Ltd.,is a private company that

Q52: Anfield Corp.is analyzing its accounts receivable for

Q53: CBC Biomedical undertook a research and development

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents