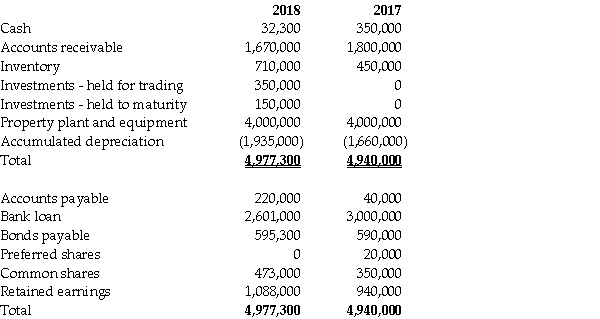

Financial information for Fesone Inc.'s balance sheet for fiscal 2018 and 2017 follows:

Additional information:

Additional information:

1.Preferred shares were converted to common shares during the year at their book value.

2.The face value of the bonds is $600,000; they pay a coupon rate of 6% per annum.The effective interest rate of interest is 7% per annum.

3.Net income was $205,000.

4.There was an ordinary stock dividend valued at $13,000 and cash dividends were also paid.

5.Interest expense for the year was $115,000.Income tax expense was $61,500.

6.Fesone arranged for a $425,000 bank loan to finance the purchase of the held-to-maturity investments.

7.Fesone has adopted a policy of reporting cash flows arising from the payment of interest and dividends as operating and financing activities,respectively.

8.The held-for-trading investments are not cash equivalents.

9.Sales = 2,000,000; cost of goods sold = 300,000; and,sales and administration expenses = 1,043,500

Required:

a.Prepare the cash flows from operating activities section of the statement of cash flows using the direct method.

b.Explain the difference between the direct method and the indirect method.

Correct Answer:

Verified

Year E...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q46: Rusabh Ltd.'s policy is to report all

Q64: Which statement is true?

A)Stock splits and dividends

Q64: Financial information for Fesone Inc.'s balance sheet

Q65: Provide a summary of presentation and disclosure

Q66: Financial information for Flagstone Inc.'s balance sheet

Q67: How are cash flows from discontinued operations

Q68: Green Leaf's activities for the year ended

Q70: Katie Ltd.'s policy is to report all

Q71: How is other comprehensive income (OCI)shown on

Q72: Reuse It Inc.'s (RII)policy is to report

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents