Changing Assumptions Ltd.has the following details related to its defined benefit pension plan as at December 31,2013: Pension fund assets of $1,900,000 and Actuarial obligation of $1,806,317.

The actuarial obligation represents the present value of a single benefit payment of $3,200,000 that is due on December 31,2019,discounted at an interest rate of 10%; i.e.,$3,200,000 / 1.106 = $1,806,317.

The pension has no unamortized experience gains or losses,and no past service costs at the end of 2013.Funding during 2014 was $55,000.The actual value of pension fund assets at the end of 2014 was $2,171,000.As a result of the current services received from employees,the single payment due on December 31,2019 had increased from $3,200,000 to $3,380,000.

Required:

a.Compute the current service cost for 2014 and the amount of the accrued benefit obligation at December 31,2014.Perform this computation for interest rates of 8%,10%,and 12%.

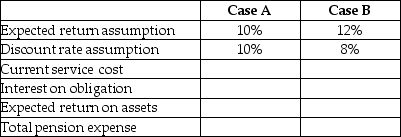

b.Derive the pension expense for 2014 under various assumptions about the expected return and discount rate.Complete the following table:

c.Briefly comment on the different amounts of pension expense in relation to the assumptions for expected return and discount rate.How does a change in the discount rate affect the accrued benefit obligation?

c.Briefly comment on the different amounts of pension expense in relation to the assumptions for expected return and discount rate.How does a change in the discount rate affect the accrued benefit obligation?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q63: What are the two components of OCI

Q69: Which statement is correct?

A)The defined benefit liability

Q79: A company has a defined benefit pension

Q80: At the beginning of the current year,a

Q82: Humming Furnishings produces quality household furniture.The company

Q85: Bram Masons' balance sheet shows a defined

Q86: Feldman has a defined benefit pension plan.The

Q87: Use the following table to explain how

Q88: Fringe Inc.produces quality leather handbags.The company has

Q89: Feldman has a defined benefit pension plan.The

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents