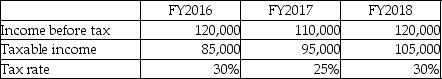

What is the deferred tax liability under the deferral method for FY2017?

A) $3,750

B) $23,750

C) $27,500

D) $36,000

Correct Answer:

Verified

Q4: GMS Corp. reported $680,000 in income tax

Q10: Compare and contrast the two tax allocation

Q18: A company earned $860,000 in pre-tax income,

Q22: A company earns $490,000 in pre-tax income,while

Q26: Under the accrual method,what is the current

Q29: Which statement is correct?

A)The deferral and accrual

Q30: Which of the following is an example

Q31: Under the accrual method,what is the current

Q33: SEG Company reported $490,000 in income tax

Q39: What is a "taxable" temporary difference?

A)Results in

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents